Mega Backdoor Roth: A Powerful Retirement Savings Strategy for High Earners

Are you searching out strategies to beautify your retirement financial financial savings beyond traditional limits? The Mega Backdoor Roth strategy is designed specifically for excessive earners who want to maximize their tax-advantaged contributions. It unlocks the functionality to locate considerably extra money into Roth debts, in which your investments broaden tax-unfastened and licensed withdrawals are tax-free as well. This guide will provide an explanation for how the Mega Backdoor Roth works, the rules you need to understand, and practical steps to place into effect this approach in clean, clean language.

Whether you’re new to retirement making plans or need to deepen your information, data the way to do a Mega Backdoor Roth should rework your lengthy-term monetary savings. Let’s discover what it is, why it’s a felony, who is eligible, and a way to keep away from commonplace pitfalls in 2025.

Table of Contents

What Is a Mega Backdoor Roth?

A Mega Backdoor Roth helps you to contribute far extra to a Roth account than regular IRS limits allow by utilizing an agency 401(ok) plan with after-tax contributions and in-carrier conversions or rollovers.

The Core Concept

You first make after-tax 401(ok) contributions past the standard pre-tax or Roth 401(k) limits.

Then, you exchange or roll over those after-tax finances to a Roth IRA or Roth 401(good enough).

This allows the cash to grow tax-unfastened and be withdrawn tax-loose in retirement, maximizing your Roth monetary savings vicinity.

How Is a Mega Backdoor Roth Different from a Backdoor Roth?

Feature Backdoor Roth IRA Mega Backdoor Roth

Contribution Limits $7,000/12 months Up to $70,000

widespread 401(ok) contributions such as after-tax buckets

Account Used Traditional IRA -> Roth IRA After-tax 401(adequate) -> Roth IRA or

Roth 401(okay)

Eligibility Income limits practice No earnings limits, but requires

for direct Roth IRA precise 401(k) plan functions

Complexity Simpler, makes use of IRAs Complex, relies upon on 401(ok) plan

pointers and conversions

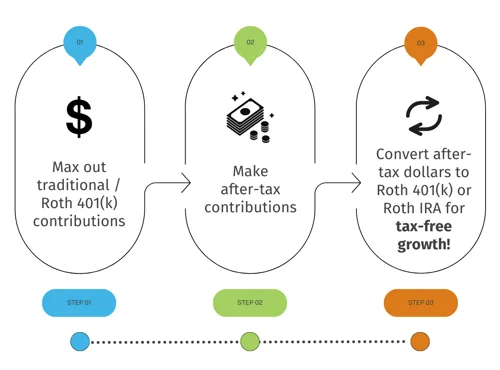

How Does the Mega Backdoor Roth Work? Step-thru-Step

1. Max Out Your Regular 401(k) Contributions

The first step is to make contributions the maximum allowed pre-tax and/or Roth 401(k) contributions.

For 2025, that is $23,500 for underneath age 50, and higher with seize-up contributions ($31,000 for a while 50-59).

2. Make After-Tax Contributions

Your corporation plan should allow after-tax contributions past the usual income deferrals.

The general 401(good enough) contribution limit for 2025 is $70,000 (or $seventy seven,500 for a long term 50-59), which includes employee deferrals + employer health + after-tax contributions.

After maxing out popular deferrals, you could make contributions the distinction as after-tax cash, likely tens of hundreds more.

3. Convert or Rollover After-Tax Money to Roth

The most critical detail is that your plan need to both:

Allow in-service withdrawals or distributions, meaning you may take cash out while nonetheless employed, or

Support in-plan Roth conversions (moving after-tax contributions to the Roth 401(k) inside the plan).

This conversion needs to be completed short to keep away from investment earnings being taxed later.

Once converted, finances increase in a Roth car, gaining tax-free remedy.

Who Is Eligible for the Mega Backdoor Roth?

You ought to have get admission to to a place of job 401(adequate) plan that lets in:

Both after-tax contributions and

Either in-provider distributions or in-plan Roth conversions.

High-profits earners who’re ineligible for direct Roth IRA contributions gain the most.

Not all employers provide those plan features—check together with your HR or plan administrator.

IRS Rules and Legal Considerations for Mega Backdoor Roth

The IRS explicitly lets in after-tax contributions and Roth rollovers under Section 401(ok) policies.

After-tax contributions are not the same as Roth 401(ok) contributions—they may be taxed when contributed but can be converted later.

You need to adhere to annual contribution limits: average contributions (worker + organisation + after-tax) can not exceed $70,000 in 2025 (with seize-up provisions).

Avoid the seasoned-rata rule tax lure by changing after-tax amounts separately from earnings to restrict taxable income.

Keep close to facts of contributions and conversions for tax filings.

Tax Implications of the Mega Backdoor Roth

After-tax contributions are made with cash that has already been taxed.

When you change to Roth, the conversion of your after-tax contributions is typically now not taxed once more.

Any funding profits within the after-tax account earlier than conversion are taxable.

Correct timing and conversion assist restrict taxes and maximize tax-loose growth.

How to Avoid Taxes on Mega Backdoor Roth Conversions

Convert the after-tax contributions without delay earlier than they generate taxable increase.

Separate the after-tax basis from profits at conversion to keep away from owing tax on profits.

Ensure your 401(ok) plan allows small or common in-provider conversions to preserve tax performance excessively.

Planning Strategies and Tools

Use a Mega Backdoor Roth calculator to estimate your general contribution potential.

Consult essential dealers (e.G., Fidelity, Vanguard) to test if your 401(adequate) lets in Mega Backdoor Roth moves.

Some Solo 401(ok) plans manual this approach, especially for small agency proprietors.

Practical Example

Imagine you are 45, incomes $ hundred,000, with a 401(okay) plan that lets in after-tax contributions and in-service rollovers.

Step Amount

Pre-tax profits deferrals $23,500

Employer fit $7,500

After-tax contributions $39,000 (to reap $70,000 general)

Total 401(k) contributions $70,000

Conversion to Roth After-tax contribution component

This lets you correctly stash $39,000 greater into Roth money owed past normal limits.

Comparing Traditional 401(okay) vs Mega Backdoor Roth

Feature Traditional 401(ok) Mega Backdoor Roth

Contribution Limit $23,500 profits deferral + organization match Up to $70,000

general together with after-tax

Tax Treatment Tax-deferred Tax-free boom, tax-free withdrawals

Increase, taxes paid at withdrawal

Income Limits N/A No profits regulations for after-tax contribs

Complexity Simple Requires plan skills and cautious execution

Frequently Asked Questions (FAQs)

Is Mega Backdoor Roth criminal?

Yes, absolutely criminal beneath IRS rules, furnishing your 401(ok) plan allows the essential functions.

Who advantages maximum from a Mega Backdoor Roth?

High earners who need to make contributions extra to Roth bills beyond regular caps.

Can I do a Mega Backdoor Roth with any 401(adequate) plan?

No, best plans with after-tax contributions and in-company withdrawal or Roth conversion alternatives.

What takes the region if my plan doesn’t allow in-provider rollovers?

You can wait till separation from the enterprise organization or find out unique funding techniques.

Conclusion:

The Mega Backdoor Roth is an endeavor-changing retirement economic financial savings approach for human beings to get right of entry to the right 401(k) plans. It empowers immoderate-income earners to develop their retirement nest egg tax-unfastened a ways past preferred limits. While the policies and execution require careful attention and appropriate plan capabilities, the ability blessings—extended tax-free growth and greater retirement flexibility—are huge. Consulting collectively with your HR department and a trusted economic guide allows you to decide if this superior method fits your goals in 2025 and past.

Meta Description:

Discover how the Mega Backdoor Roth 401(adequate) technique should high earners contribute more to Roth money owed, maximizing the tax-free retirement boom in 2025.