Ethereum Price: Comprehensive Insights on ETH Value in 2025

Have you ever looked at the Ethereum live price and thought about what is happening to make it move like it is? Being the second-largest cryptocurrency in the world, Ethereum is not only a digital currency; it has become the basis of decentralized finance, NFTs, and smart contracts. Any movement in its current ETH value means something to a trader, an investor, or a developer.

In this guide we are going to dive deep into what Ethereum is today, why markets are prioritizing this market right now with Ethereum price history and Ethereum price drivers, as well as incites to Ethereum price prediction detailed analysis of 2025. It does not matter why you are here, be it to trade, invest, or just explore the crypto world, all you want to know are right here all the time.

Current Ethereum Price Overview

- Live Ethereum price: ~$4,329 USD

- 24-hour trading volume: ~$64.89 billion

- ETH circulating supply: ~120.7 million ETH

- ETH market cap: ~$517 billion

- ETH dominance chart: Strong second place behind Bitcoin

Ethereum’s price momentum remains bullish in 2025, recently nearing its previous Ethereum all-time high of $4,878. This climb is driven by institutional buying, strong ETH market trends, and ongoing network upgrades.

History and Main Milestones of Ethereum Price

2015 2016: Ethereum coin worth less than $15 as it started adoption.

2017: Rocketed above 1000 dollars in the conditions of an ICO boom.

In 2021, it reached an all-time high of around 4,878 and was helped by DeFi and NFTs.

2022: The Ethereum price correction post proof-of-stake transition after merge.

20232025: Partial recession and high movement in the direction of 4000.

This history of ETH depicts how Ethereum transformed itself into a world blockchain juggernaut.

The variables that may affect the Ethereum price in 2025

1. Network Upgrades

Deployment of scalability, and Pectra upgrade.

Lower charges and cheaper transactions creating usage.

2. Post-Merge Impact

Deflationary tendencies can be observed by lower issuance and analysis of ETH tokens.

Security holders who are long-term are encouraged by staking incentives.

3. Institutional Adoption

Ether futures ETF and hedger big selling.

Beneficial effect on liquidity and ETH price study.

4. Regulatory Developments

Price can erupt and dive following ETH after regulation news.

Definite rules tend to increase the confidence of the investors.

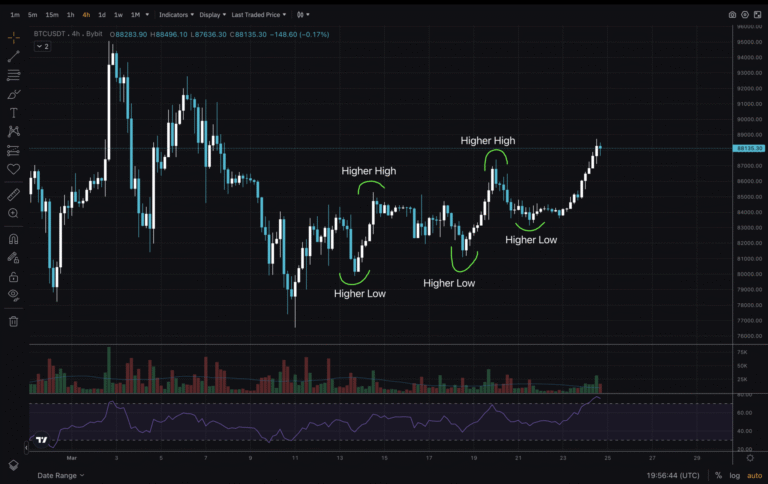

Ethereum Price Analysis and Market Trends

- Support level: ~$4,000

- Resistance level: ~$4,800–$5,000

- Moving averages: Bullish alignment of 50-day and 200-day.

- Ethereum trading volume remains high, signaling healthy participation.

Current ETH market trends point toward gradual appreciation, barring macroeconomic shocks.

Ethereum Price Predictions for 2025

| Prediction Source | Price Range |

| Token Metrics | $3,900–$5,090 |

| Changelly | $5,900–$7,200 |

| Capital.com | $2,000–$6,000 |

Most analysts remain optimistic, citing upgrades, staking demand, and global DeFi growth as drivers for Ethereum price forecast 2025.

Ethereum Trading and Investing

Trading With Ethereum

Day traders make the short-term use of ETH day trading technique.

The Ethereum swing trading tips allow swing traders to swing multi-day moves.

Long-term holders are interested in the mainnet staking and DeFi.

Investment Tips about Ethereum

Shake up your crypto portfolio.

Go through ETH portfolio tracker.

Theme sensitivities to significant benchmark prices of Ethereum.

Risk Management

To hedge against the price of ETH when crypto crashes, have stop-losses.

Keep an eye on the data on Ethereum futures sentiment.

Event-Driven Price Movements

- Ethereum price after network upgrade: Usually bullish.

- ETH during bull run: Often outperforms altcoins.

- Ethereum in bear market: Good accumulation opportunities.

- ETH after ETF approval: Historically positive reaction.

Ethereum vs Other Cryptocurrencies

| Asset | Price (Approx.) | Market Cap | Notes |

| Bitcoin (BTC) | $118,885 | $2.3T | Store of value |

| Ethereum (ETH) | $4,329 | $517B | Smart contracts hub |

| Solana (SOL) | $180 | $97B | Fast throughput |

| Cardano (ADA) | $1.37 | $46B | Research-focused |

| Binance Coin (BNB) | $810 | $113B | Exchange utility |

The Ethereum vs Bitcoin price gap remains large, but ETH leads in decentralized application activity.

Ethereum Price Tracking Tools

- Platforms with Ethereum price charts (e.g., CoinMarketCap, TradingView).

- Live up to date prices on mobile apps.

- To plan the investments, ETH profit calculator.

- Volume and liquidity ethereum market data dashboards.

Conclusion:

The market share of Ethereum in 2025 is maturity and innovation in one. With a trading price of about 4,329 and more than 500 billion in market value, ETH is among the best crypto choices in the portfolio. One must learn its history, motivating factors, and trends, whether it is Ethereum price prediction models, network upgrades, etc. to make sound decisions. Whether you have long-term or short-term swings in gap placement, being well informed is the key to the changing nature of the cryptocurrency market.

Meta Description:

Learn more about Ethereum price, latest, live updates, its history, and 2025 predictions. Get to know how to trade, current market trends and driving forces affecting the ETH value.