BTC Price: In-Depth Guide to Bitcoin Value and Market Trends in 2025

Do you ever wonder about the price of the BTC and why it takes one direction and not another? Whether as an individual making their first investment or a crypto day trader or even as one who takes a weekly glance at the market we are finding ourselves in the situation where Bitcoin still reigns in the news and redefines the manner in which individuals perceive money.

In 2025, BTC does not only exist as a digital asset, it is a global financial power. In this guide we will look at the Bitcoin price today, its past performance, the forces behind it and what experts say is in store in the future. In the end, you are going to be in a clear, data-informed position of where BTC lies and where it may be going.

Table of Contents

Up to date BTC Price Overview

At the time of writing it is August 9, 2025 and Bitcoin is worth $118,838 per coin and the market cap is at $2.37 trillion. That signifies a small 0.5 percent decline within the past 24 hours however speaks of a 74 percent increment compared to past year.

- BTC price live: 118 838.03

- Market cap: 2.37 trillion

- 24 hour trade volume: ~38 billion

- Circulating supply 19.9 million BTC (95% of the maximum supply)

BTC is still the biggest cryptocurrency in terms of market cap and continuously gathers the attention of institutional and retail investors.

Past BTC Performance Price

The history of Bitcoin is a combination of soaring and serious downturns:

- 2009-2013: zero to a fraction of a cent to over 1K.

- 2017: Max peak of close to 20,000 then a sharp correction.

- 2021: Went over the $60,000 mark with popular uptake.

- 2024: Shattered the million dollar mark after ETF approvals.

- Mid-2025: hit its highest level ever at $124,386.

This trip is an indication of how Bitcoin has gone through a transition to becoming a mainstream investment instrument.

The Prominent Influences on BTC Price

1. Institutional Adoption

Increasingly more BTC is being introduced into the portfolio of more hedge funds, pension funds, and large corporations. Bitcoin ETFs have also simplified the purchase of BTC to conventional investors.

2. Regulatory Clarity

Uncertainty has been eliminated by positive regulation in the US, EU and Asia. The transparency of taxation policies and trading systems has increased the levels of confidence of investors.

3. Short Supply & Poring in Half

The issue of scarcity is brought about by the use of 21 million coins of BTC. The mining rewards are reduced by half after each halving event, traditionally a bullish driver, and the next award reduction will take place in 2024.

4. Macroeconomic Trends

Cases of global inflation and lowering of interest rates by central banks make investors find interest in hard assets such as Bitcoin.

5. Market Sentiment

Buying or selling waves can be initiated by social media trends, the opinions of influencers, and the dominance charts of the BTC.

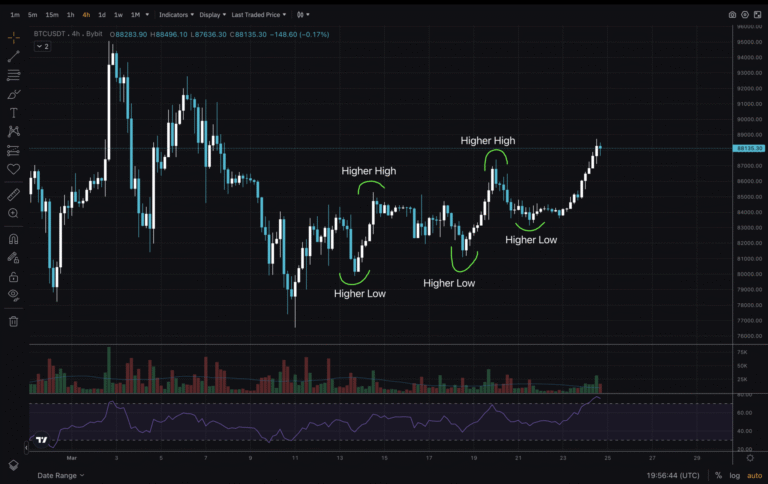

Technical Analysis of BTC Price August 2025.

- Support: 114,500

- Resistance: 125,000

- 50 moving average: Bull uptrend above 116,000

- RSI (Relative Strength Index): 68 (getting close to being overbought)

- Volume statistics: In order to keep the prices stable there should be robust buying volume.

According to the chart patterns, the BTC might retest again at the $125,000 as long as the current support was not broken.

BTC Price Predictions for 2025

| Source | 2025 Forecast |

| CryptoRaven | $130,000 – $135,000 |

| NAGA | $120,000 – $200,000 |

| Changelly | Around $128,000 |

While forecasts vary, most analysts remain bullish due to strong institutional demand and limited supply growth.

BTC in Context: Comparing Assets

| Asset | Price | Notes |

| Bitcoin | $118,838 | Largest crypto, store of value |

| Ethereum | $4,329 | Smart contracts & DeFi leader |

| Gold | $3,350/oz | Traditional safe haven |

| S&P 500 | ~5,250 | Stable but lower growth potential |

BTC stands out for its high growth potential but comes with high volatility.

BTC Price at Large Events

Post-ETF Approvals (2024): Caused explosive inflows and took BTC to over 100K.

The price growth in the long-term was assisted by supply shock after 2024 Halving.

Fed Rate Cuts (2025): Increased demand as the investors changed towards the risk-on asset.

The BTC Prices Tracking and Trade

Get BTC live price charts.

Past market cycles to be studied using historical data.

Portfolio tracker to keep holdings.

To react to flits, alerts and watchlists.

The BTC Price advice to traders, investors, and others

Keep an eye on the market of BTC on a daily basis.

Time the entries and exits via technical analysis instruments.

Become diversified, do not put all money in BTC.

Be on top of regulatory news items.

You must remember to exercise your risk tolerance when making a trade.

Conclusion:

Bitcoin in 2025 is at $118,838 and it has a market cap of more than 2.3 trillion dollars. The fact that it is scarce, it has been adopted on an institutional level, as well as in macroeconomics, keeps it on the leading edge of the cryptocurrency market. Both long-term traders and more traditional investors should learn as much as possible about the price of BTC today, its past trends, and the factors that drive it in order to know their way in this unstable but potentially solid investment.

Meta Description:

One BTC costs 118 838 dollars with a 2.37T market capitalization. In this comprehensive bitcoin market guide, investigate trends, history and analysis, and predictions of Bitcoin 2025.